As soon as your SmartAsset AMP subscription begins, we will begin sending you referrals within your targeted investable asset levels and geography. Your dedicated account manager will provide support and training on how best to use our wide range of tools to help you increase conversion across your SmartAsset AMP campaign.

¹The estimated AUM closed by advisors from SmartAsset referrals is based on the number of matches made between validated investors reporting over $25K in investible assets and advisors in 2023. Further, the calculation assumes: a 4% close rate (based on data collected from partners and industry benchmarks) and an average amount of assets per household of $996K, that was calculated from self-reported asset ranges in the advisor matching survey. The calculation is: Valid Matches*Average Assets Per Household*4% Conversion Rate.

²The average estimated payback period is calculated across all SmartAsset AMP subscriptions. The estimate assumes a 3% client close rate, the following AUMs for each lead tier based on actual historical data, and a 1.1% advisor fee on the AUM. The payback period calculation is: (Year 1 subscription cost divided by Year 1 advisor fee earned)*12 months. Tier 1: $1,598,087. Tier 2: $593,533. Tier 3: $280,064. Tier 4: $62,500.

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. SmartAsset’s services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. SmartAsset receives compensation from Advisers for our services. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any user’s account by an Adviser or provide advice regarding specific investments.

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

SmartAsset.com is not intended to provide legal advice, tax advice, accounting advice or financial advice (Other than referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States). SmartAsset is not a financial planner, broker or tax adviser. The Service is intended only to assist you in your understanding of financial organization and decision-making and is broad in scope. Your personal financial situation is unique, and any information and investing strategies obtained through SmartAsset.com may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.

Less time prospecting, more time closing.

Here’s how it works.

Investors take a detailed survey

Investors in search of financial advice fill out our survey with over 30 questions about their investments, goals, and financial preferences.

Step 1

They are reviewed

SmartAsset's in-house concierge team validates investors. If they are able, they will connect you in a 'Live Connection' so you can set an appointment right away.

Step 2

They are nurtured

Once an investor is referred to you, they'll receive automated, compliant drip messages to keep you top of mind. Your personalized messages educate them about you.

Step 3

Step 4

You make the close

Once an investor is ready to move forward, you can focus on closing.

Estimated ROI on an Accelerate Package

TARGET CLIENTS PER YEAR

LEADS PER MONTH

COST PER NEW CLIENT

PAYBACK PERIOD

REVENUE PER CLIENT

YEAR 1 ROI

3 YEAR RETURN

7+

20-26

$4,226

7.8 months

$6,529

54%

$49,023

Accelerate

SUBSCRIPTION

TIER

Assumptions: Lead conversion rate: 3%. Leads' average assets: $593K. Advisor fee: 1.1% on AUM. ROI = (Advisor Fee-Annual Cost) / (Annual Cost).

Schedule a free demo

Reviewed referrals & Live Connections

We not only have an in-house team for validating investors by phone, but we'll directly connect you in real-time to facilitate your first conversation.

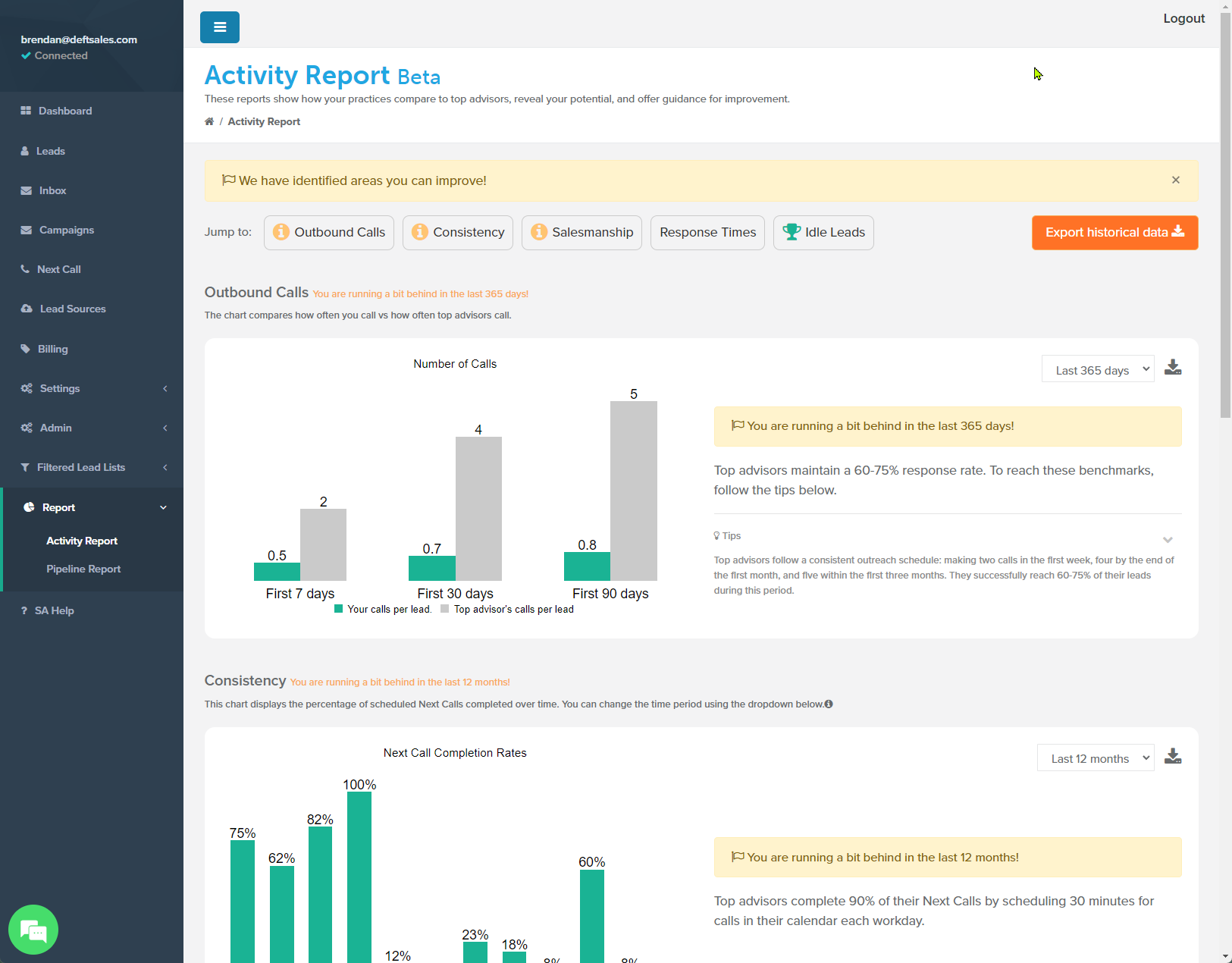

A reporting dashboard

Automated reporting for your emails, campaigns, and user data designed to help you refine your individual follow-up process.

As an advisor with SmartAsset AMP you get

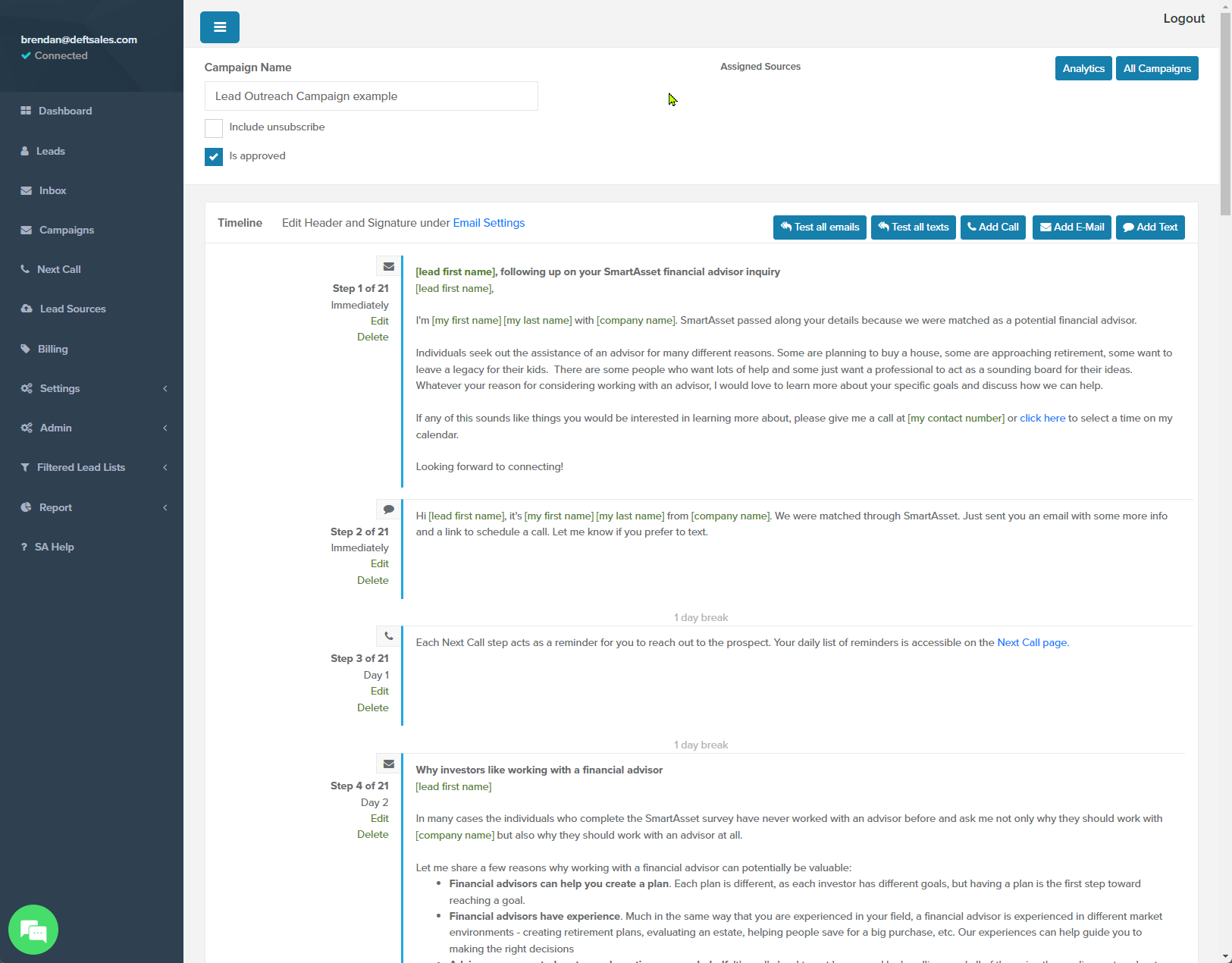

Automated follow-ups to convert prospects

Leverage call, text, and email campaigns that are automated, personalized, and compliant to help build trust and convert prospects.

No CRM data entry

Automatically populate prospect information into your CRM so you can spend your time advising clients.

Over 50,000 investor-advisor matches made every month.

SmartAsset is the largest advisor marketplace on the web, matching over 50,000 consumers with fiduciary advisors every single month.

$996K

in average investable assets

66%

do not currently have advisors

82%

are retired or near retirement

We work with firms of all sizes:

SmartAsset AMP can streamline the client acquisition process by reducing your need to prospect as well as automating a significant part of the nurturing process, allowing you to concentrate on closing deals and providing value to your clients.

We believe that SmartAsset AMP is a fully compliant Rule 206(4)-1 solution specifically designed for Financial Advisors. If you have any compliance questions our in-house compliance team would be happy to help.

SmartAsset has an in-house concierge team dedicated to validating leads.

SmartAsset AMP allows you to target referrals based on their investable assets. One of our investable asset tiers targets consumers that only have over $1 million of investable assets. To learn about all of the targeting and investable asset tiers available, please schedule an appointment.

No problem, we can help! SmartAsset AMP is designed to help structure and automate your sales process, thus increasing outreach and close rates. Your dashboard helps keep you organized by displaying your investor referrals in order of priority for follow-up. Automated, compliant outreach helps nurture leads so you can focus on selling. You also have your campaign analytics so you can tweak your approach based on data.

SmartAsset AMP has integrations with Salesforce, Hubspot, Zoho, Redtail, SmartOffice, Pipedrive, and Wealthbox.

Microsoft, Google, Exchange, or any SMTP/IMAP email service can be integrated with SmartAsset AMP.

With scheduling links in your automated outreach emails, leads can seamlessly book a time with you. AMP easily integrates with leading scheduling tools like Calendly, ScheduleOnce, Microsoft Bookings, Acuity, and HubSpot Meetings. When your calendar scheduling tool is integrated with AMP, once a meeting is booked, your AMP campaign will cease contacting the prospect automatically, so your messaging is responsive to an action taken by the referral.

Yes. Your subscription comes with onboarding and a dedicated account manager. Your account manager will be a partner in your success, beginning with an initial setup session and follow-up call to ensure you’re onboarded smoothly. Account managers can provide advice on growth, increasing ROI, and assist with any questions that come up along the way. We also have a customer support team available for additional assistance.

SmartAsset helped advisors close an estimated $34 billion in AUM in 2023¹. Each month, we match over 50,000 retail investors with fiduciary advisors based on geography, willingness to work with a remote advisor, and investable asset tier. SmartAsset AMP is designed to produce successful outcomes for advisors based on years of iterative testing and development. AMP provides the marketing systems and automations that advisors need to nurture and close clients effectively.

SmartAsset AMP is a semi-annual or annual subscription that is billed evenly every month for the length of your subscription. Speak to a representative if you need a different billing cadence.

SmartAsset is an independent company that has raised $161 million of venture capital. Our investors include Javelin VP, TTV Ventures, IA Capital, YCombinator and management.

FAQs

SmartAsset Advisor Marketing Platform (AMP)

Referrals. SmartAsset is the nation's largest marketplace connecting consumers to advisors. We'll match you with high-intent investors that you can target based on geography and investable assets.

Live Connections. Our Concierge team makes live, over-the-phone, introductions of referrals to you to help maximize your ability to close new clients.

Compliant automated calling & texting outreach. Automated, personalized mobile and SMS outreach helps handle the grind of prospecting, so you can focus on closing the deal.

Nurture campaigns. Send automated email nurture campaigns to keep up with prospects who need a longer sales cycle.

CRM Integration. Integrates with common CRMs like Salesforce and Redtail if you already use one to manage your prospects.

Dedicated Account Management. A dedicated resource to provide ongoing consultative support and answer any questions that come up along the way.

A leading end-to-end marketing solution for fiduciary advisors looking to grow their practice. We offer referrals, automated outreach, and dedicated account management to help attract AUM to your firm.

Data provided as of January 2024. Average investor investable assets doesn't include consumers reporting <$25K in investable assets, is calculated using the midpoint of asset tiers selected by the consumer, and aggregated over 2023.

Data provided as of January 2024. Average investor investable assets doesn't include consumers reporting <$25K in investable assets, is calculated using the midpoint of asset tiers selected by the consumer, and aggregated over 2023.

Less time prospecting, more time closing.

Here’s how it works.

A Marketing Machine Built for Advisors

Automate your outreach to save time while you grow your AUM

Michael Collins has grown his AUM by $50 million with SmartAsset

"For every $1 I put in, I earn $2 in recurring revenue.

The most important client acquisition strategy for us has been SmartAsset. The quality and ROI of SmartAsset leads has been much higher than other services we have tried."

Michael C., CFA®

Financial Advisor

Michael Collins, CFA®, is a client of SmartAsset and was not compensated for his participation in this interview. However, he has since become a paid consultant. Michael's experience and metrics regarding SmartAsset

are his own

Joe Anderson has raised over $1 billion in AUM from SmartAsset since 2019

If I spend $1 million with SmartAsset...I know we'll bring in $100 million of assets. I'll do that all day long because I know the long-term value of the client is a lot more than that."

Joe Anderson, CFP®

CEO & President of Pure Financial Advisors

Joe Anderson, CFP®, is a client of SmartAsset and has not been compensated for his participation in this interview. Joe's experience and metrics regarding SmartAsset are his own. Results may not be the same for everyone who uses SmartAsset.

"Today we manage roughly $6 billion...and a little bit more than $1 billion is from SmartAsset.

Robert Gilliland's Modern Client Acquisition Playbook Added a Reported

~$50M in AUM in 3 Years

Robert Gilliland, CRPC®

Managing Director and Senior Wealth Advisor

Robert Gilliland, is a client of SmartAsset and has received compensation for his participation in this interview. Robert's experience and metrics regarding SmartAsset are his own. Results may not be the same for everyone who uses SmartAsset.

"My experience with regards to SmartAsset is every year I’ve done it I've brought in between $15 million and $25 million worth of assets directly attributable to SmartAsset."

This Young Advisor Closed Around 1 New Client a Month with SmartAsset

"I've really reached a good spot now, where some of the leads that I think I would have lost at one point, I'm converting into clients because I've gained the expertise just by working it over time."

TJ Tamura

Financial Advisor and Retirement Planner

TJ Tamura, is a client of SmartAsset and has received compensation for his participation in this interview. TJ's experience and metrics regarding SmartAsset are his own. Results may not be the same for everyone who uses SmartAsset.

"I'm getting about one, I think I average one to one-and-a-half clients per month from my leads from SmartAsset, and I've already generated about a 3 to 3.5 times ROI."

Hear from Successful Advisors

Are You Struggling to Meet Affluent Prospects?

Automated lead generation and nurturing with one subscription.

- SmartAsset helped advisors close over $34 billion in 2023

- A typical investor has $996k in investable assets

- Automatic, compliant nurture campaigns, so you can focus on closing

FEATURED IN:

Boost your AUM starting now.

Discover

Target 3+ clients per year

- Up to 120 referrals each year

- Real-time Live Connections included

- Dedicated Account Manager

Accelerate

Target 7+ clients per year

- Up to 276 referrals each year

- Real-time Live Connections included

- Dedicated Account Manager

Scale

Target 15+ clients per year

- Up to 540 referrals each year

- Real-time Live Connections included

- Dedicated Account Manager

SmartAsset AMP is estimated to have an average payback period of 6.6 months.²

Are You Struggling to Meet Affluent Prospects?

Automated lead generation and nurturing with one subscription.

- SmartAsset helped advisors close an estimated $34 billion in 2023¹

- A typical investor has $996k in investable assets

- Automatic, compliant nurture campaigns so you can focus on closing